Digital Wallets: Trust & Integration for Increased Adoption

Ever since Apple Pay launched in 2014, mobile payments and wallets have quietly yet steadily grown from ever-so-slightly faddish curiosity (well, in The West at least), to a genuinely credible consumer trend that may well prove to be the shape of things to come in the world of commerce.

Mobile wallets are essentially a virtual version of a physical wallet, allowing consumers to:

- digitally store their credit and debit cards, to be used to pay for products either online or in physical locations (via contactless tech), just like a traditional wallet

- store digital versions of other useful and valuable artefacts, such as tickets, coupons and vouchers — or even personal ID

Whilst mobile wallet usage has well and truly gone mainstream in China via the super app that is WeChat, uptake in The West has been a little more modest. Whilst contactless payments have taken off in the UK, where 80% of consumers have reported making a purchase via contactless (compared to less than 20% in the US) only 14% of UK consumers are reported to have used a smartphone to pay.

That said, many believe that mobile wallets are soon to become the global norm — and that represents a pretty big deal for commerce businesses and marketers. In the U.S., mobile wallets are expected to surpass the use of both credit and debit cards by 2020.

And then of course, there’s the juggernaut example of China, whose use of mobile payment and wallet technology is considered by many as the ultimate foretelling of what’s to come. Fueled by WeChat, China’s uptake of mobile payment is nothing short of astonishing, with some predicting the country may soon become the first truly cashless society.

So what does all of this mean in relation to ecommerce and marketing?

Well, it’s in specific relation to their ability to store, share and use transactional content — such as loyalty and referral vouchers/codes – that mobile wallets represent an interesting potential proposition.

To help us understand a little bit more, let’s consider an interesting example of mobile wallet content usage we came across, recently...

Case study: The Body Shop

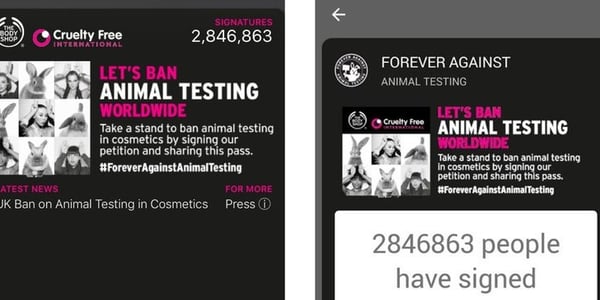

The Body Shop’s creative use of mobile wallet tech in support of their Forever Against Animal Testing campaign, caught our eye, in that it goes beyond the usual expected use of mobile wallets by say, banks for payment management or airlines for issuing virtual travel documents.

What the ethical cosmetics brand did was subtle yet very effective. As well using the usual expected marketing channels such as email and text to promote shareable content, The Body Shop offered signatories of their online petition the chance to be kept up to date with a ‘digital news pass’.

If the user agreed, the pass was downloaded into their mobile wallet, allowing the brand to push updates and news relating to the campaign, into their mobile wallet app.

Key factors in the brand’s thinking behind the use of the pass, was basic pragmatism related to consumer trust. As Russell Longley, senior manager of CRM and digital development at The Body Shop, explains:

“We know 52% of our transactions online are mobile; our customers are in the mobile space. We know that consumers are regularly active on only five different [apps]. We knew we couldn’t convince them to download another app for us to talk to them as a brand.”

The result was essentially a low-commitment and trustworthy format for connecting with large numbers of supporters, in a way that extended the conversation between The Body Shop and its consumers, beyond the initial commitment of signing the petition.

So what could ignite real growth in digital wallets?

Unsurprisingly, trust is one of the key factors consumers mention for not taking up mobile wallets as a method for payments. According to recent research 72% of Brtis say that they worry about paying with contactless or with their mobile phone.

But secondary to this is convenience. At the end of the day, are digital wallets that much more convenient that taking out your card to make a payment?

The Bodyshop example mentioned earlier perhaps gives a pointer as to what is needed. If payments themselves are no more convenient than cards, consumers need another benefit to motivate them.

Bundling in a loyalty and reward element so that the digital wallet captures relevant codes and vouchers would streamline the checkout process.

The customer journey is increasingly blurring the lines between online and offline with consumers surfing online before completing their purchase offline (“webrooming”). Mobile order ahead is becoming increasingly popular, particularly in the restaurant industry, but has yet to become mainstream in other sectors.

The bottom line is, digital wallets will take off when they add more value to the consumer. If they successfully tap into the customers journey - from ordering at home, speeding the checkout in-store, rewarding loyalty and even enabling referral between friends - that would really make a digital wallet a no-brainer.

Angela Southall

Read more >

Never miss another update

Subscribe to our blog and get monthly emails packed full of the latest marketing trends and tips