Why Existing Customers are the Ticket to Success for Travel and Hospitality Brands

Read time: 9 mins

The past decade has seen a tidal wave of disruption in the financial services sector. Online challenger banks like Revolut and Monzo have raised the bar of customer satisfaction, while big tech providers like Apple launching digital cards and other financial services products has created a far more dynamic and competitive market.

Traditional organisations that once dominated the banking and insurance scene are now under intense pressure to adapt or lose out to their competitors. Slow customer service processes and clunky, analogue technology that customers once accepted are no longer good enough.

To win in today’s landscape, financial service providers must evolve how they operate, guided by one North Star: customer satisfaction.

Once you put your customers at the heart of your marketing strategy and start thinking advocacy-first, you’ll soon reap the rewards — keep reading to find out how.

Build Trust and Improve Your Brand Reputation Through Customer Love

When it comes to money, there are few things more important than trust and brand reputation. We’re unlikely to readily hand over hard-earned cash without doing our research first. And that research often involves asking those we trust for their recommendations. The prospect of purchasing a premium insurance policy, for example, feels a lot less daunting when it comes with the seal of approval of your cost-conscious friend.

Even the most expensive brand-building campaign is unlikely to match the impact of a genuine recommendation from someone we already trust. A friend or relative’s positive word-of-mouth recommendation will always be more likely to spur action than a splashy billboard or paid ad on Facebook.

And to nurture your customers to the point of advocacy where they can’t wait to share your brand with others, customer love needs to be central to every decision you make.

While it can be tempting to knuckle down on budget-saving tactics when economic times are tough, don’t fall into the trap of doing so at the expense of client satisfaction.

Banks and insurers focused solely on their product and operating in silos risk leaving customers feeling frustrated and going elsewhere. We’ve all experienced the frustration of trying to get through to the bank, only to be passed from department to department in a bid to get your problem resolved.

Instead, find ways to delight your customers in ways that build a positive brand reputation and keep customers coming back for more — and bringing along their friends and family.

Gain A Better Understanding of Your Customer Needs

By taking an advocacy-first approach, you can also learn more about your customers’ needs in a number of ways.

Firstly, you can A/B test referral offers to find out exactly what makes your customer advocates tick. Is your customer base more motivated to recommend your service when offered a discount, or would they rather receive a third-party voucher? Do they get more inspired by short-and-snappy copy or more descriptive messaging?

And you never know — some of your findings may surprise you enough to tweak other elements of your marketing strategy.

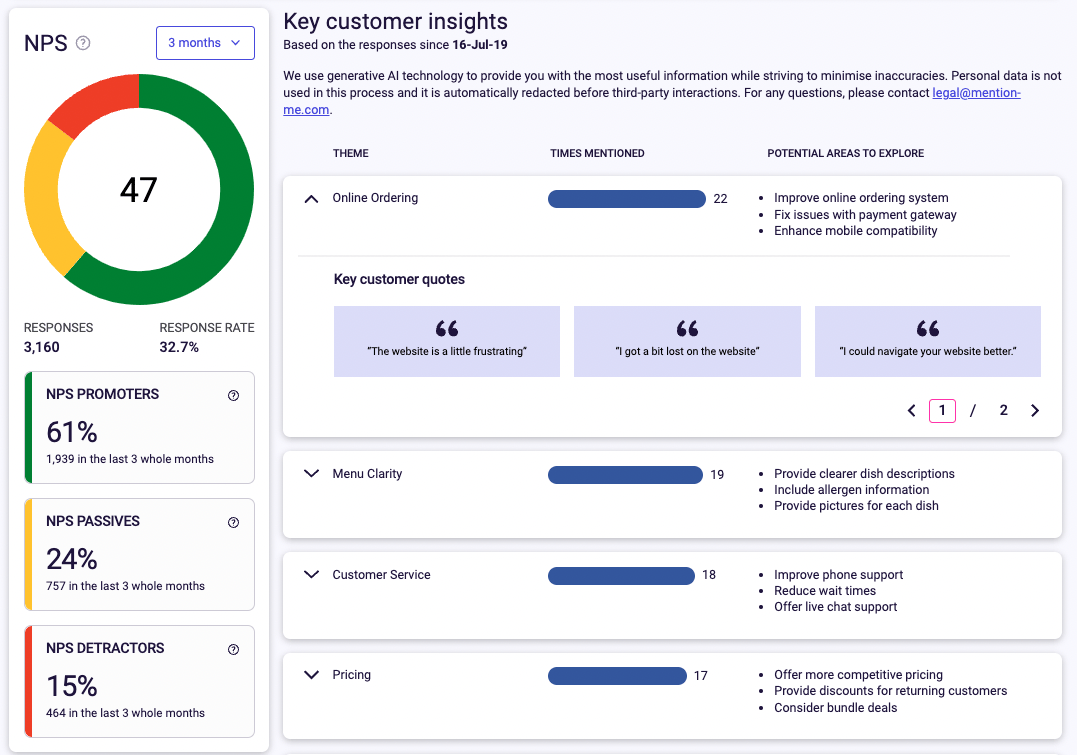

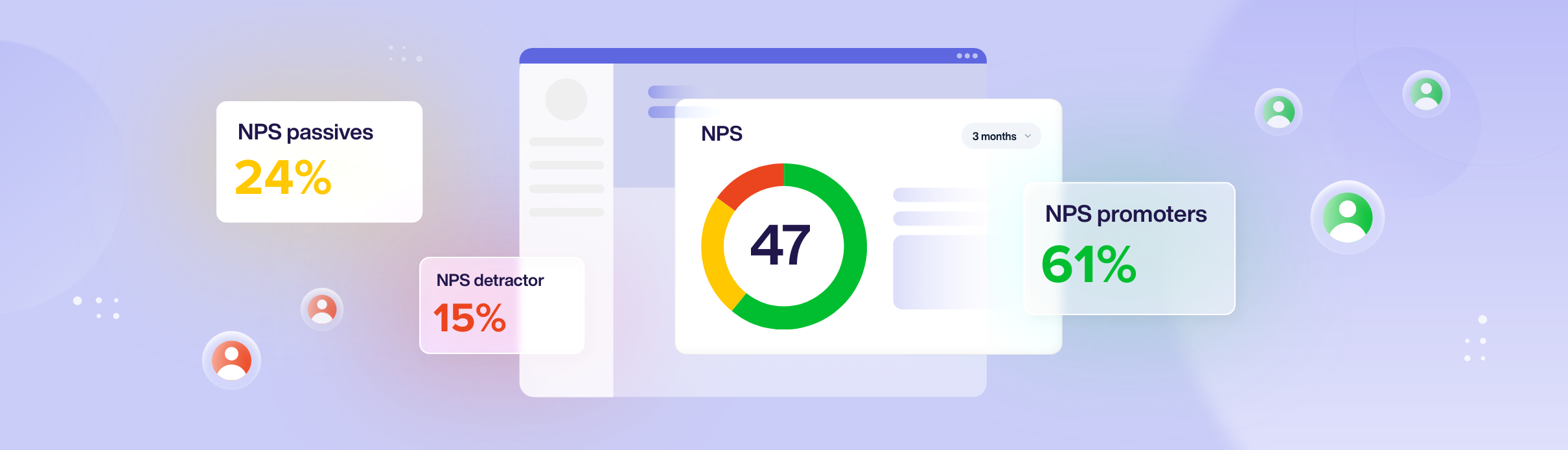

You can also prompt other actions that encourage positive customer engagement to learn more about their needs, such as asking them to fill in an NPS survey.

As you collect these scores, pay close attention to their feedback so you can improve their experience and drive higher customer satisfaction.

Because as well as requiring a service that keeps their finances secure, customers today are looking for exceptional experiences at every point in their customer journey. So the more you can learn about what’s driving advocacy in your customer base, the quicker you can put passive customers on the path to becoming loyal brand fans.

Break down the key drivers for your NPS with our Sentiment Analysis feature

Break down the key drivers for your NPS with our Sentiment Analysis feature

The Impact of Positive Word-of-Mouth

When we look at how positive word-of-mouth is driving success across our 500-strong client base, financial services regularly come out as the most frequently recommended brands of any sector. Better still, more of these recommendations convert into new customers than other sectors.

In the last three months, 40% of referrals for financial services converted into new customers. And that’s only one way you can turn customer satisfaction into sustainable revenue.

As we mentioned before, trust and brand reputation are more critical for financial service brands than most other sectors. Because when our money is at stake, we want all the social proof we can get before we take a leap of faith.

So another advocacy-driving action you can encourage customers to take that generates a goldmine of social proof is leaving a public review on your website.

Once you’ve identified your happiest customers through these reviews, use your first-party advocacy data to encourage them to take even more actions to nurture them along their advocacy journey, such as by signing up for your newsletter or referring a friend.

With each step they take towards becoming a fully-fledged advocate, the more valuable they’ll become for your business. Which leads us nicely onto…

Maximise Customer Lifetime Value and Extended Customer Revenue

When you acquire new customers through encouraging positive word-of-mouth recommendations, you’re also acquiring more valuable customers.

We’ve found that customers acquired through personal recommendations spend 11% more on their first order and have a higher customer lifetime value than customers acquired through other channels.

But their value doesn’t just come from their own spend.

These customers are also 5x more likely to refer onwards, meaning they’re delivering value to your business even when they’re not spending themselves.

By tracking positive word-of-mouth recommendations, you’ll gather rich advocacy data that identifies exactly who your best customers are. You can even discover the impact of their Extended Customer Revenue — that’s the total of their own spend plus that of everyone they refer — to see the true impact that customer love is making on your business economics.

And if you use your advocacy data to segment your customers and deliver personalised experiences for your VIPs on other channels, you can encourage greater customer engagement to drive an even higher customer lifetime value from your advocates.

A referral chain in action

A referral chain in action

Improve Customer Engagement and Satisfaction — and Beat Your Competitors

Gone are the days when banks could simply push products without considering the evolving needs of their target consumers. In today’s competitive landscape, the hyper-personalised, slick offerings of fintechs and big techs have raised the bar of customer needs and expectations.

Banks and insurers focused solely on their product and operating in silos risk leaving customers feeling frustrated and going elsewhere. We’ve all experienced the frustration of trying to get through to the bank, only to be passed from department to department in a bid to get your problem resolved.

As in other sectors, the root of success for financial services challenger brands is prioritising their customers above all else. If incumbent insurers and banks want to avoid losing business to newer offerings on the market, they look beyond their products to put customer love at the heart of everything they do.

Customer centricity is more than just a buzzword: it’s a game-changer in financial services. It means reimagining banking from a customer’s perspective and offering tailored experiences that cater to their individual financial goals.

As well as acquiring new customers, a customer-centric approach will also help financial services businesses retain existing ones. And with an increasing number of competitors vying for consumers’ money, retaining a loyal customer base is now crucial for your success.

By identifying customers who rate you enough to share your brand with others, you can treat them in ways that make them even more likely to introduce friends. And when they do tell others about your offering, their friends are highly likely to convert into high-quality customers. Referred customers are more likely to choose a premium product, stay loyal, have a longer customer lifetime, and refer you onward – sparking an exponentially growing referral network.

Look at Linxea, the French personal wealth management provider whose customer advocacy programme drives a greater return on investment than any other channel, with cost-per-acquisition coming in at 30% below target. It’s not hard to see why: 24% of customers refer Linxea to friends, and 62% of these referrals convert into new customers.

As the marketing landscape continues to evolve at lightning speed, the financial services providers that evolve their approach to think advocacy-first will be the ones to win. By focusing less on paid channels like Google and Facebook, and more on truly putting their customers’ needs first, banks and insurers will leapfrog their competitors and build a loyal customer base – now and in the future.

Sophia King

Read more >

Never miss another update

Subscribe to our blog and get monthly emails packed full of the latest marketing trends and tips