Money talks: why referral customers are a growth goldmine for financial brands

Read time: 7 mins

Looking for the highlights? Here are three things you need to know:

- Finance and insurance brands have the highest conversion rate for referrals of any sector this year

- Finance and insurance is the second most referred category this year

- In Q2 and Q3 2021, 57% of all referrals converted into new customers

Money, money, money. It’s what makes the world go round (supposedly). But it’s also something Brits hate making decisions on — let alone talking about.

We may want to bury our heads in the sand to avoid even thinking about money, but we all have to manage our finances somehow. And given the uncertainty of the last two years, we’re more cautious than ever: one third of Britons have grown their personal savings by an average of £4,500 since the pandemic.

To take care of these precious funds, we’re seeking out trustworthy financial providers. And how are we finding them? By asking people we trust. In fact, the two most recommended brands in the UK this year were financial services, with two more featuring in the top ten.

At a time when as many as 60,000 UK customers switch banks each month and seven in ten insurance holders actively shop around for better deals, personal recommendations could be the final piece of the puzzle for growing your financial service.

If you’re a provider with a precision-engineered referral channel, consumers’ reliance on recommendations from friends (and their willingness to make recommendations themselves) opens up a door to majorly expanding your customer base. Here’s why.

People seek out recommendations for finance and insurance providers…

Of course I can tell you why your financial service should set up a referral channel, but seeing as you’re probably a numbers person, I’ll back it up with cold, hard evidence.

First of all, order levels for providers in the financial sector have massively increased. In Q3, orders were up 65% from the previous quarter and 8% year-on-year. And as we enter a new year, January is bound to bring a swarm of customers eager to get their 2022 finances in check by switching banks, setting up smart investments or getting a great new deal on their insurance. So find out how to deliver a brand advocacy strategy for your financial service, consider implementing a precision-engineered referral channel. By harnessing the power of personal recommendations, you can tap into the trust and influence of existing customers to expand your customer base.

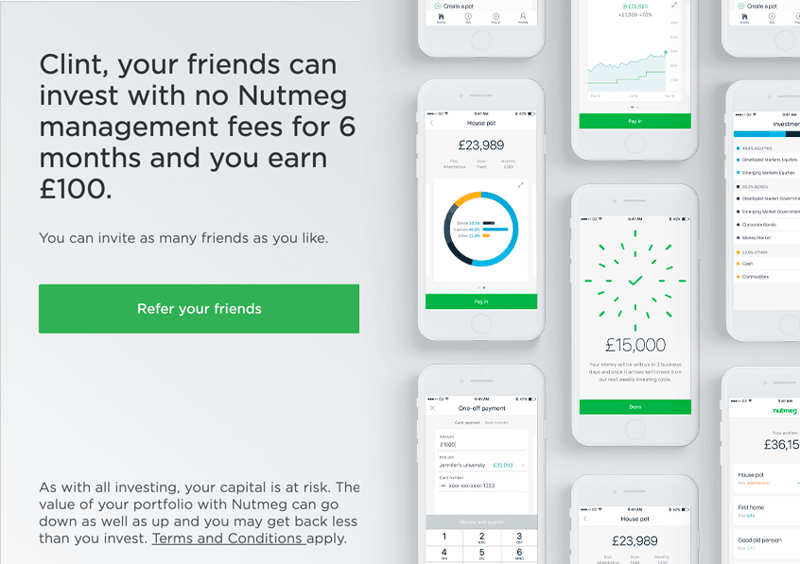

Digital investment manager Nutmeg offers 6 months of no fees and £100 for its referral incentive

Digital investment manager Nutmeg offers 6 months of no fees and £100 for its referral incentive

Better still, customers who’ve already signed up to new providers are so impressed that they’re sharing them with their equally savvy friends and family — and they’re sharing them at large. Financial services are some of the most recommended out of all our 450+ clients. In fact, finance and insurance is our second most referred category this year.

...and over half of these recommendations convert into new customers

All of these recommendations aren’t just disappearing in a puff of smoke into the busy background of our daily conversations; consumers are acting on them. A lot.

Financial services have the highest conversion rate for referrals of any sector this year (22% higher than the second best performing sector). Across Q2 and Q3 2021, 57% of all referrals for financial services have converted into new customers.

This is down to the fact that consumers trust recommendations from friends and family more than any other source of advertising. That trust skyrockets when it's a recommendation about something as important as our finances.

Not only do we trust these recommendations, but we actively seek them out. When shopping around for insurance providers, for example, one fifth of Britons rely on personal recommendations to make their choice. While we may be content to simply consult the first page of Google if we’re looking to buy a new toaster, there's a bit more at stake than a burnt bagel when money is involved.

When referral customers are a key growth driver, a referral marketing platform helps you quantify that value and integrate referral performance with your broader acquisition metrics.

Your customers are already talking about you — turn these conversations into a high-performance marketing channel

Us Brits might not like talking about money, but when we talk about it because we’re recommending financial providers, we listen to one another... and we’re happy to part with our cash.

A Referral Engineering™ channel takes these trusted recommendations and transforms them into a mighty catalyst of brand growth.

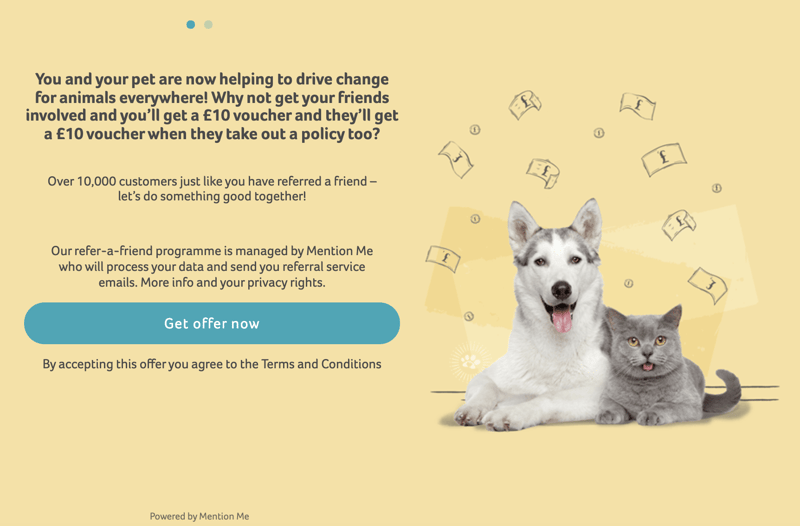

Because recommendations don’t only lead to more customers. They also lead to more valuable customers. This was the case for insurance provider Animal Friends, which discovered that orders placed by referred customers are an average of 12% higher in value than orders placed by other customers.

Pet insurer Animal Friends gives £10 vouchers to referrers and referees

Pet insurer Animal Friends gives £10 vouchers to referrers and referees

You can even drive value directly from the real-life conversations your customers are having about your service with our Name Share™ feature. This lets customers claim referral rewards simply by giving the name of the person who referred them at checkout.

So when Hannah is showing off her swanky new bank card at dinner, her friends can sign up for their own (and get an incentive) without a lengthy code or link. For financial providers leveraging these everyday conversations, this can drive huge results; pet insurer Bought By Many was able to double its volume of social shares through Name Share™.

The truth is, a referral channel just makes sense for finance and insurance services. Consumers are looking for recommendations, and your loyal customers are keen to refer you to their friends. With the addition of intelligent referral data and A/B testing to optimise your channel, you can reach new heights of customer acquisition and accelerate long-term growth.

Want to learn more about Referral Engineering™ can achieve your ambitious business goals and hit all of your KPIs in 2022? Get the Beginner’s Guide to Referral Engineering™.

Olivia Cox

Read more >

Never miss another update

Subscribe to our blog and get monthly emails packed full of the latest marketing trends and tips